It’s Time to Post Your OSHA Form 300A

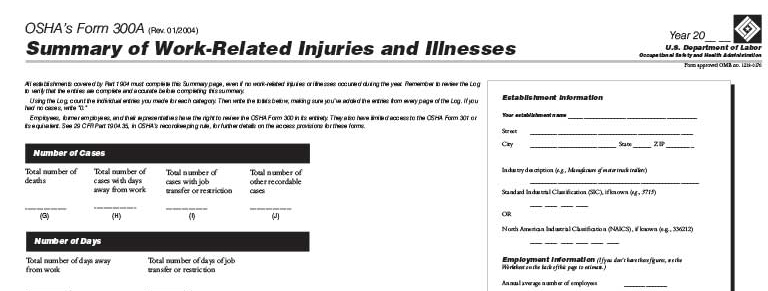

Employers with 10 or more employees must post their completed OSHA Form 300A by Feb. 1 and keep it posted in their workplace until April 30. The form must be posted where the company usually posts other employee notices, like minimum wage and workplace safety notices. Form 300A summarizes the total number of fatalities, missed […]

It’s Time to Post Your OSHA Form 300A Read More »